The Household Debt and Credit Report indicate that delinquencies of 90 days+ for all types credit are on the rise, and some exceeding or moving closer to levels not seen since the Great Financial Crisis.

Interesting Takeaways:

- Credit card 90 day+ delinquencies are higher than Q1 2008 (9.49) versus today at 10.69 an increase of 12%.

- Student Loan Delinquencies have not yet kicked in, as of Q1 student loan delinquencies stood at 0.62%

- The pause on student loans has not been lifted long enough to start to see any uptick in delinquencies. We could start to see an uptick in Q2 report, which could show signs of weakness in the consumer and other forms of debt repayment. We are at extreme historic lows due to this variable. This will not last.

- Mortgage Delinquencies are on the rise reaching 0.6. This is still historically low. Q108 hit 3.94 (556% higher than current measure) for this metric. However, I suspect this will increase much higher due to the following:

- Student loans returning will drain consumer savings rapidly, leading to failure to pay off other loans

- Auto loan 90 day+ delinquencies are 4.41 vs 3.22 for Q1 2008 and raising fast

- As many say “first the credit cards, then the car, then the house”

- Unemployment due to continued white-collared job layoffs and lack of hiring will likely impact this measurement in the coming quarters as well.

- Student loans returning will drain consumer savings rapidly, leading to failure to pay off other loans

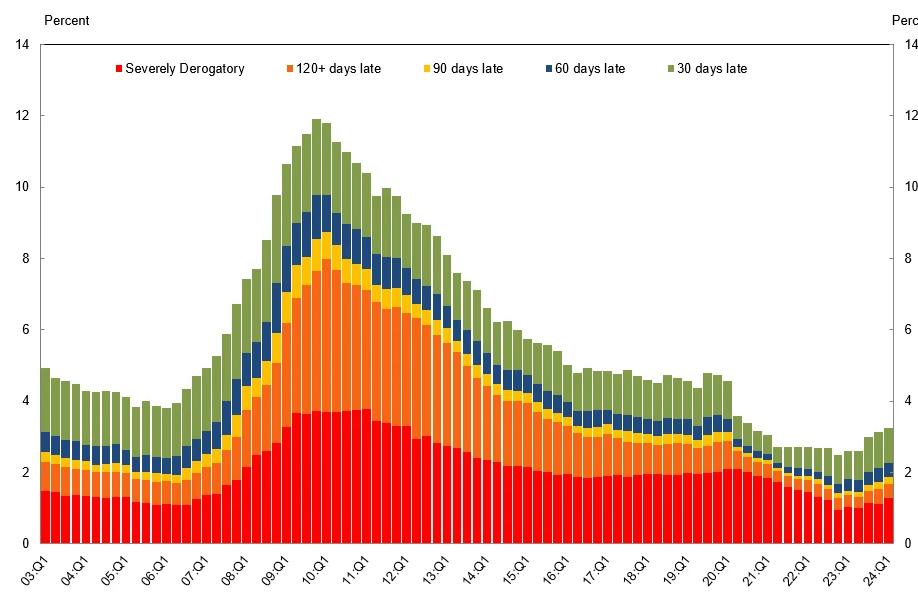

Visual of Delinquencies

Total Balance of Delinquencies on the Rise

- As part of this analysis, it is clear that the balance of delinquencies is on the rise. With interest rates on credit cards being at all time high, there is a chance this compounds to 2008 levels quickly. This measure totaled to 7.4 in Q1 of 2008 which is 124% higher than our current levels of 3.3.

For this quarter’s report, most trends related to credit, including foreclosures and bankruptcies are on the rise. Most of these measures are currently at or near historic lows due to “kicking the can down the road” via moratoriums for student loan payments and foreclosures during COVID. These measures will all see a relatively large increases over the next several quarters.

I suspect that rising inflation and student loans returning will impact delinquencies towards higher rates for the younger age brackets (18-29). This won’t directly impact the mortgage delinquency rates as most homes are not owned by this age bracket. However, lower spending leads to worse company performance, leading to job cuts due to lower demand.

Meanwhile “phantom” debt that isn’t included in this report from “Buy Now Pay Later” is ballooning. This will begin to cause weaker performance from the 30-39 and 40-49 age brackets (link), should the unemployment rates increase as mentioned before, this would be the perfect storm for this age bracket, spiking mortgage delinquencies to concerning levels.

Other important takeaways, include “Other” delinquencies are growing at a rapid rate and do not include Buy Now, Pay Later. This is limited to: “Consumer Finance (sales financing, personal loans) and Retail (clothing, grocery, department stores, home furnishings, gas etc) loans.”

All in all, these are my thoughts, they may be very dumb and very wrong 🙂

Leave a comment